US Bank is the parent company of U.S. Bank National Association, has $663 billion in assets, 11.6 million customers, and is the fifth largest banking institution in the United States.

US Bank

UX/UI Designer

Automated Investor

The exact number of customers using U.S. Bank's Automated Investor isn't publicly disclosed.

However, U.S. Bank's Automated Investor manages a substantial amount of business, with approximately $35 billion in assets under management.

U.S. Bank's Automated Investor was originally released in May 2018. The November 2021 update that brought significant enhancements which contributed to the following numbers.

These numbers reflected the positive reception of the enhanced user experience.

Overview

At the time, customer adoption rate of the Automated Investor feature for US Bank was lagging behind expected projections and they decided a UX redesign was necessary.

US Bank expected the revamped platform to improve user engagement, increase customer trust, and cater to a wider audience with varying levels of financial literacy. They invisioned a seamless design that would simplify portfolio management and provide customers with clear insights into their financial goals, risk tolerance, and potential outcomes.

US Bank hired me to join their team for my expertise in designing user-centered interfaces, my ability to translate complex data into easy-to-understand visuals, and my proven track record in creating accessible digital solutions.

After meeting with stakeholders and analyzing insights from pre-existing data, we concluded that automated services sometimes are seen as offering one-size-fits-all solutions lacking the personalized touch of human advisors and customers may be hesitant to trust automated systems with their investments. This clearly pointed out to me how trust is paramount in financial services.

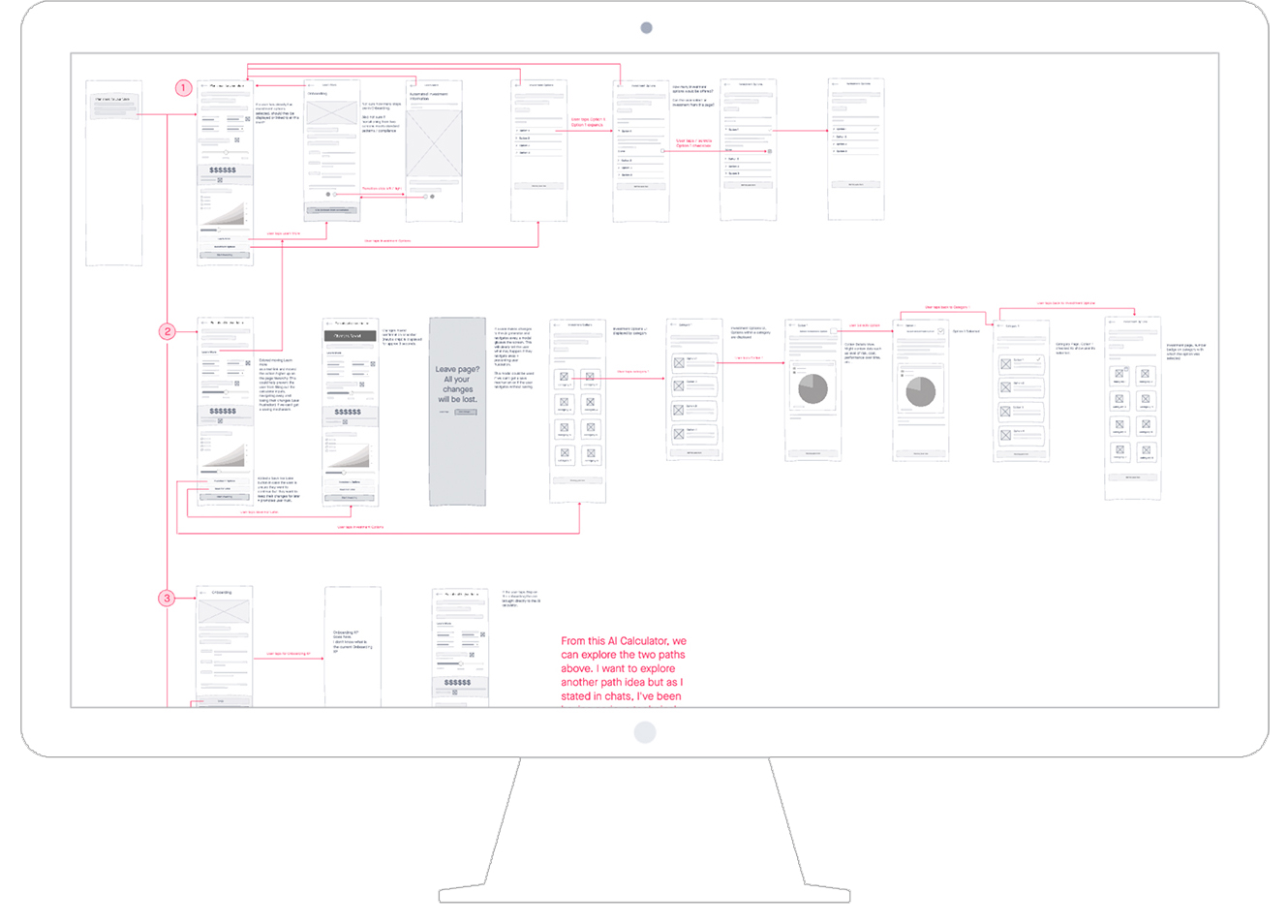

Prior to development, after utilizing pre-existing data I drafted three viable workflow variations which I presented to the stakeholders to vet and get buy in.

During this stage, I emphasized that we could mix and match patterns to test and find the optimal solution to the problem. As a result, a viable path was found, prototyped, and tested for further discovery.

After the research and Ideation phase, I shifted my main focus on translating insights into tangible solutions addressing the specific needs and pain points that were uncovered.

Throughout the process, my goal was to balance functionality and simplicity while creating an experience that fostered user trust and confidence in their financial decisions.

Additionally, the market for automated investment services is very competitive so the UX had to clearly differentiate itself and convey superior value.

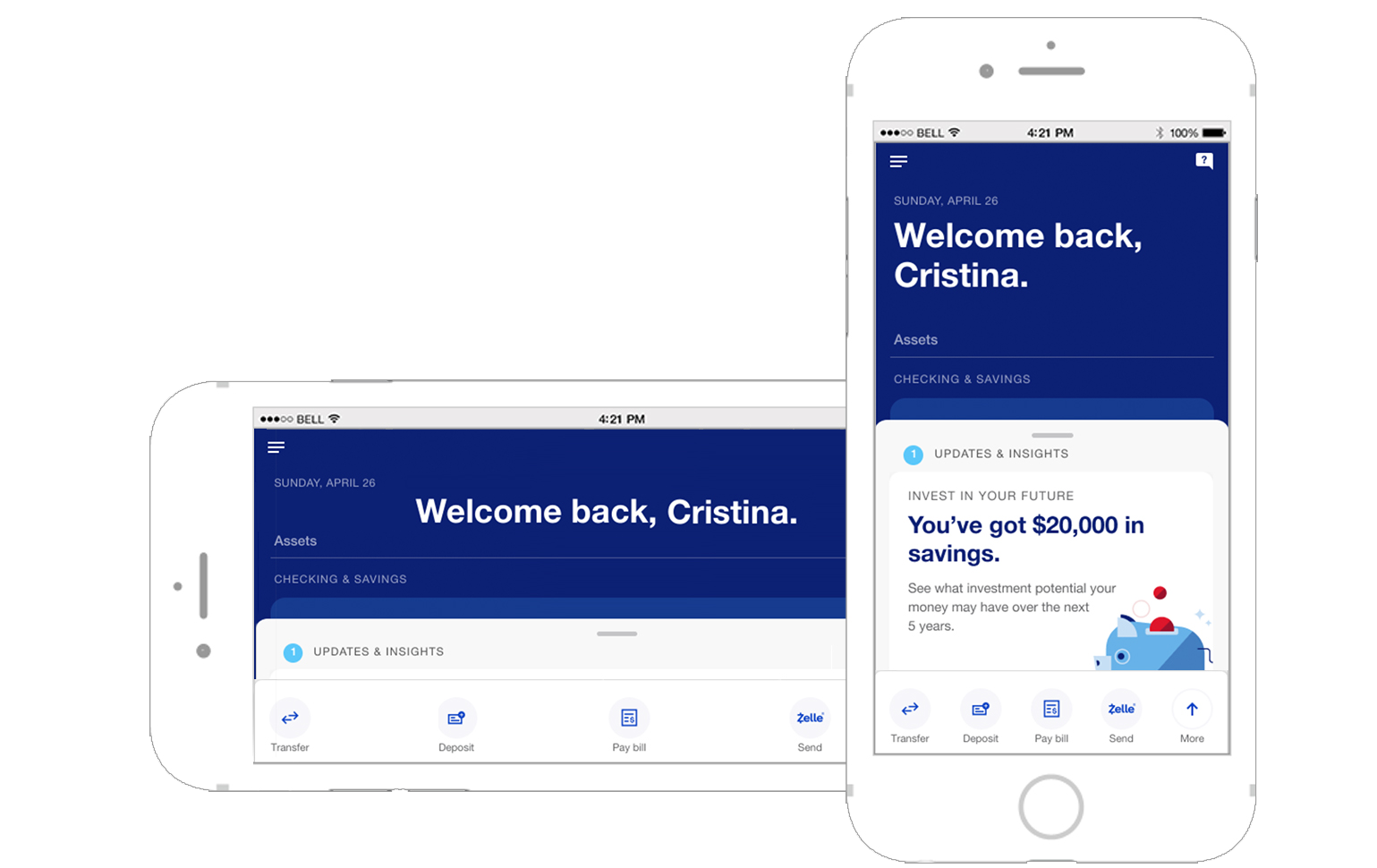

At the path origin, I designed a clean and user friendly interface highlighting essential information and quick actions at a glance.

I prominently introduced a slide up collapsable 'lazy' or 'try' teaser card providing customers easy access to the Automated Investor feature.

The card featured a brief description displaying thier account value upfront and an eye catching graphic to to encourage feature exploration to increase customer engagement.

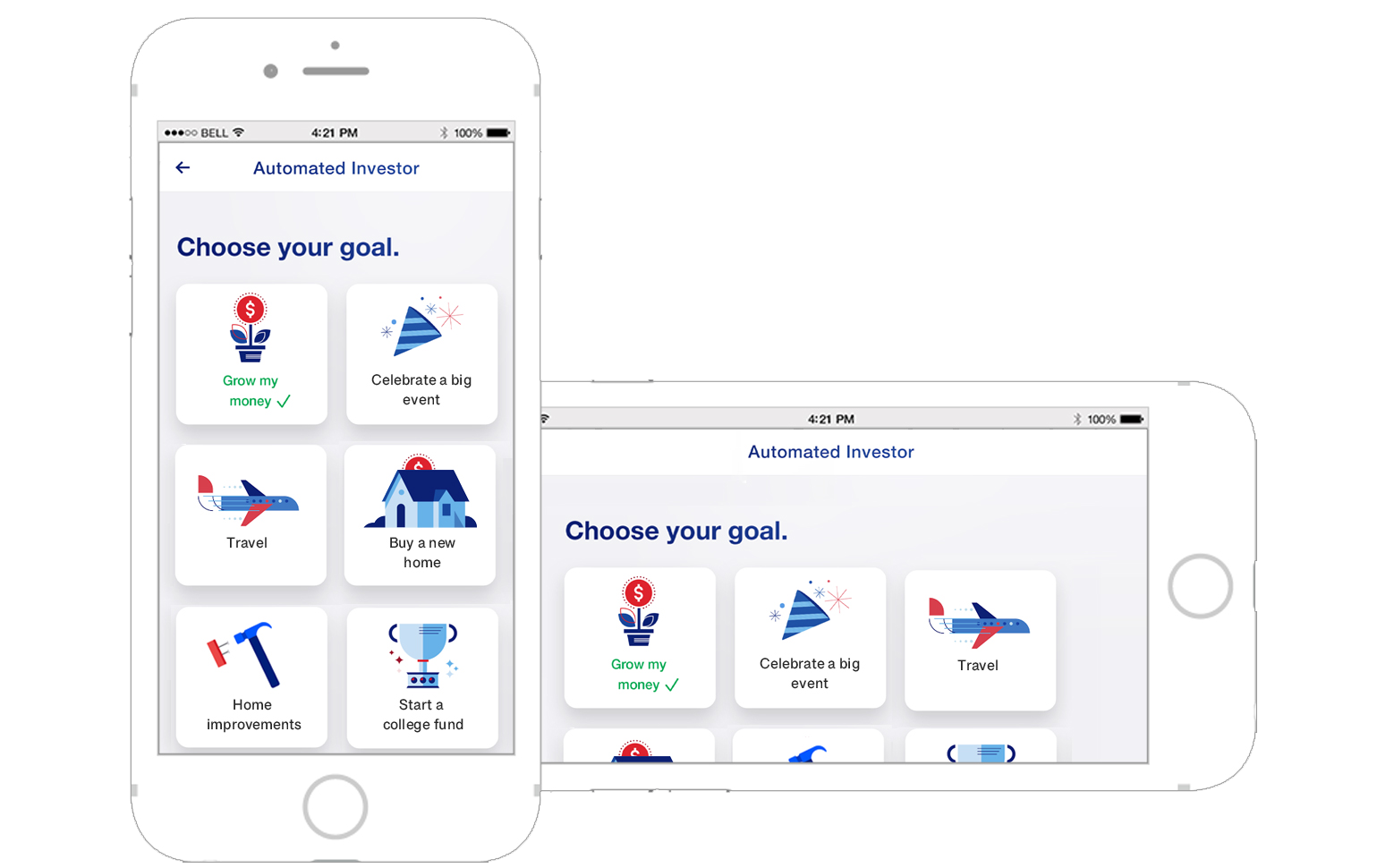

From the insights gleaned from research I identified that customers valued clear financial goal setting as a key component in managing their investments.

I incorporated this insight into the design by embedding goal setting prompts directly into the Automated Investor workflow allowing cutomers to define personal investment objectives such as retirement, purchasing a home, saving for education and more. By aligning the investment tool with customer specific aspirations made process more engaging.

Furthermore, I designed large buttons and incorporated spot illustrations from marketing which proved to be a better option than rows of text and links that were used on the previous iteration.

These improvements resulted in better click / tap thru performance, increased user engagement, and added a human touch which fostered user trust.

Customers must understand that no investment is without risk so risk assessment was a critical component of the Automated Investor feature. It's designed to help users determine their risk tolerance and align their investment strategies with market fluctuations.

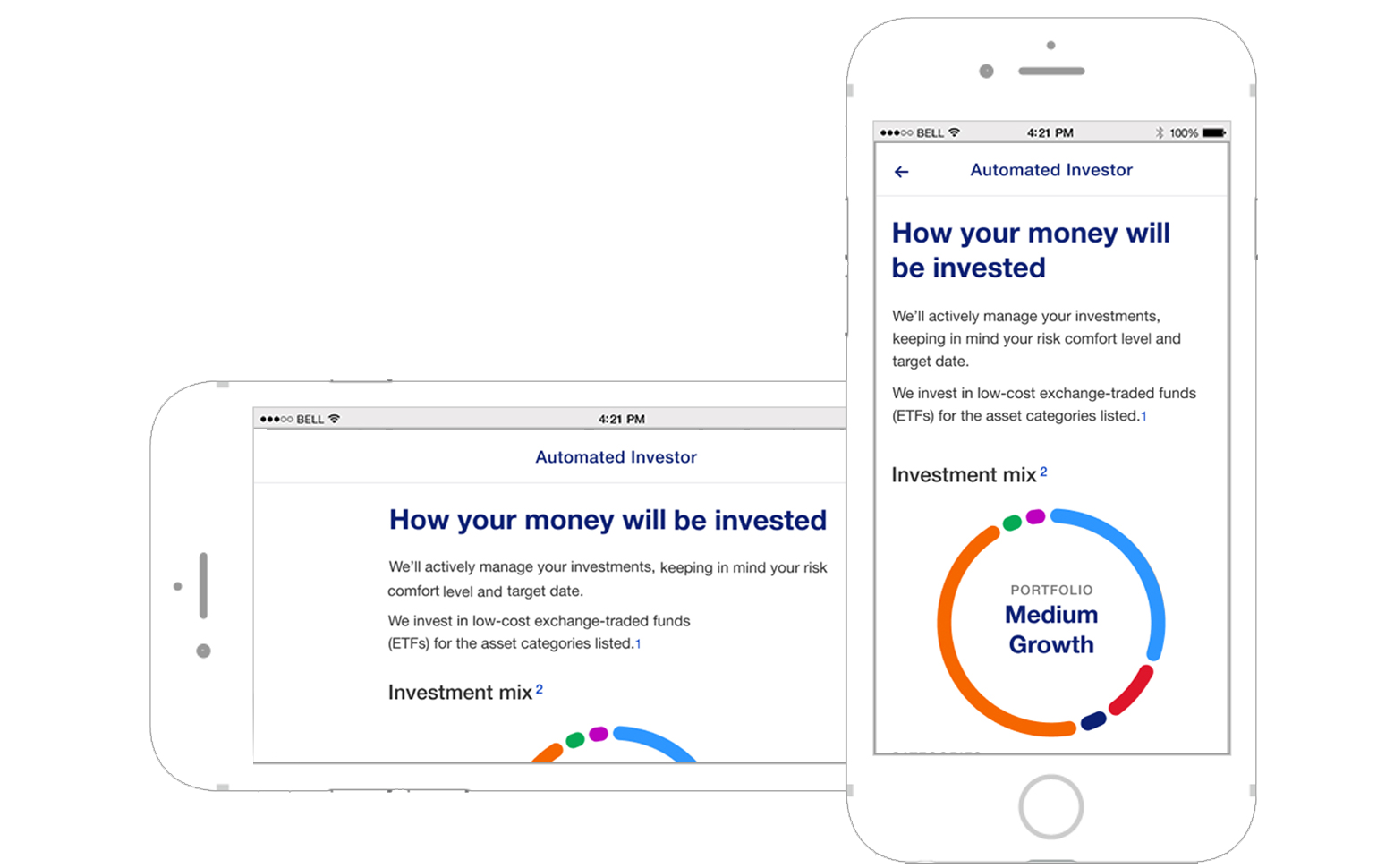

I designed the UI to make this process simple and accessible allowing users to easily modify their risk tolerance and receive immediate visual feedback providing transparency into how different risk levels impact potential returns. This ensured customers could adapt their portfolio without friction and maintain control over their investments while feeling confident in their decisions.

Real-time feedback and clear visualizations further help customers understand the impact of any adjustments they made which made for a more responsive and user-centered investment experience.

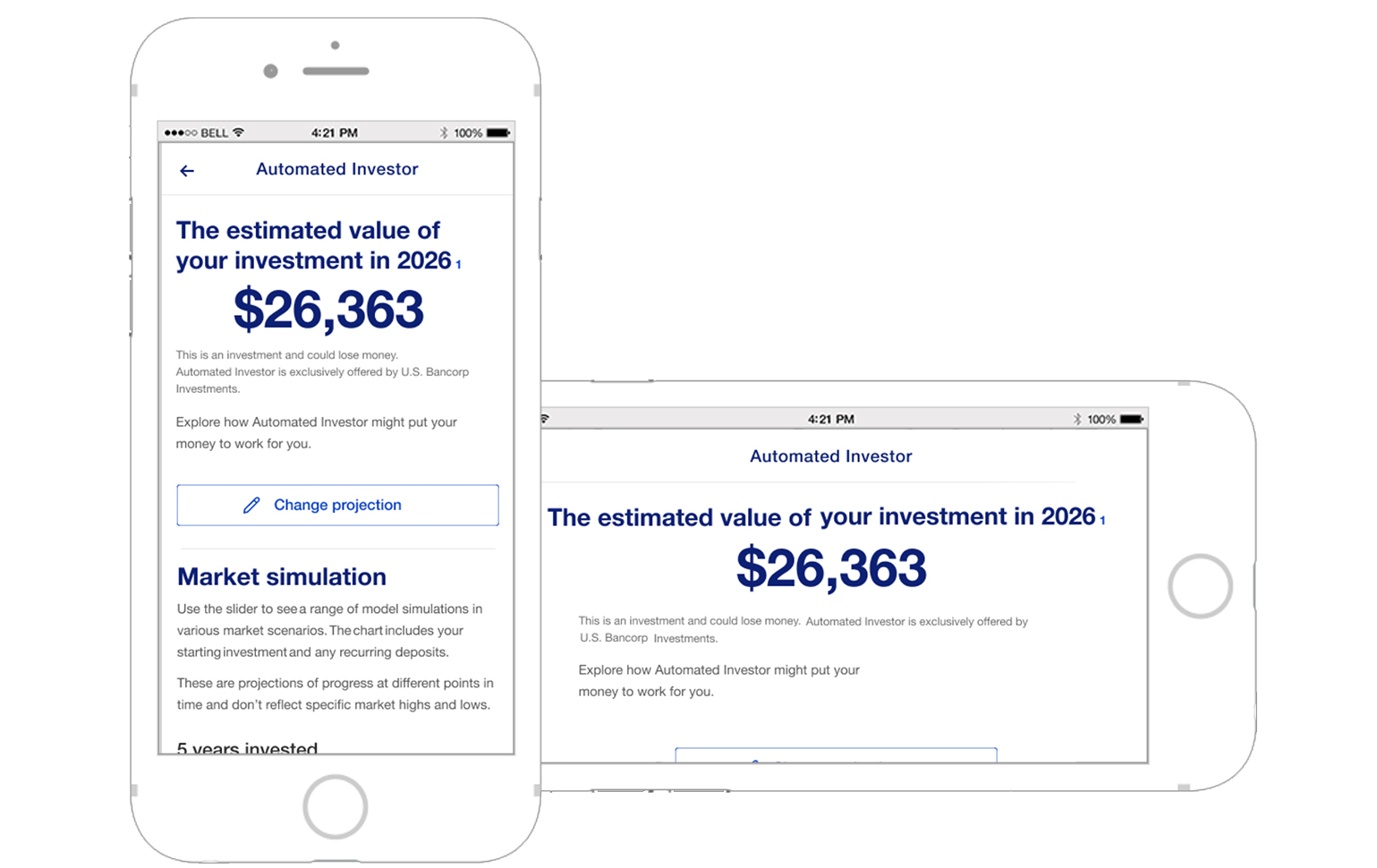

Fluctuations are frequent in markets and fluctuations often lead to short term gains and losses, especially in higher risk strategies.

To mitigate this, I designed the UI to include clear visualizations of potential gains and losses, helping custmers see how different market conditions may impact their investments over time.

By providing transparency and tools for users to to quickly pivot and adjust their risk tolerance, the design and platform empowered customers to make informed decisions while understanding the inherent risks and rewards of their chosen path.

Additionally, the use of clear and concise language in the design helped customers understand the investment process and feel confident in their decisions.

US Bank Takeaways

Working for US Bank was my first experience in financial services. What I was reminded of is that designing with clarity, transparency, and trust is crucial. In this case customers should easily understand investment options, risk assessments, and potential returns through the design. Intuitive navigation, informative visuals, and concise language empowered users to make informed decisions.

Maintaining a seamless and secure user experience was essential due to the sensitive nature of financial transactions. Adhering to these principles built trust in the Automated Investor feature and ensured compliance with legal requirements.